by Amineddoleh & Associates LLC | Apr 19, 2021 |

Join our founder and other experts for an important event addressing the effects of international sanctions on the preservation and protection of cultural heritage. Iran’s astounding cultural heritage has developed over many millennia. But during the past decade, Iranian heritage has had to contend with the sanctions era, a period in which political and practical challenges have made heritage management, research, and cultural tourism more difficult. In this unique webinar hosted by the Heritage Management Organization and the Bourse & Bazaar Foundation, these challenges will be discussed by experts with first-hand knowledge of how Iran’s cultural sector has had to adapt in order to remain connected to global exchanges on arts, culture, and shared patrimony.

Join our founder and other experts for an important event addressing the effects of international sanctions on the preservation and protection of cultural heritage. Iran’s astounding cultural heritage has developed over many millennia. But during the past decade, Iranian heritage has had to contend with the sanctions era, a period in which political and practical challenges have made heritage management, research, and cultural tourism more difficult. In this unique webinar hosted by the Heritage Management Organization and the Bourse & Bazaar Foundation, these challenges will be discussed by experts with first-hand knowledge of how Iran’s cultural sector has had to adapt in order to remain connected to global exchanges on arts, culture, and shared patrimony.

The discussion will be moderated by Kyle Olson of the University of Pennsylvania, whose five-part article series published by the Bourse & Bazaar Foundation, explored the impact of sanctions on the cultural heritage sector in Iran. Our founder has written about the effects of politics on heritage (with an emphasis on Iran) in a law review article published in 2020, available here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3572987

Our law firm addressed the topic in a blog post here (https://www.artandiplawfirm.com/why-cultural-heritage-should-not-be-destroyed-to-punish-a-nation/). Our founder even drafted the official statement of the Lawyers’ Committee for Cultural Heritage Preservation (LCCHP) calling for the protection of heritage in Iran.

Register for the April 27 event here: https://mailchi.mp/bourseandbazaar.com/iran-heritage-management-under-sanctions

by Amineddoleh & Associates LLC | Apr 9, 2021 |

Nyan Cat

NFTs, or non-fungible tokens, have taken the art world by storm during the last month. With these works raking in millions of dollars in sales, collectors are eyeing digital art and collectibles as viable investments. So what exactly are NFTs? They are crypto assets created by minting a digital file on a blockchain, which serves as an indelible record of ownership, authorship, and other attributes of an associated artwork. Once minted, NFTs can be bought and sold across a variety of platforms, with each subsequent transaction recorded on the blockchain, creating a provenance in real-time with each transaction. These digital files, or tokens, can be associated with both physical and digital art and offer many exciting benefits. For example, the near limitless flexibility in coding these tokens has allowed artists to ensure they receive a fraction of all future sales of an artwork, a remedy artists have been seeking for years and which is known as the Artist’s Resale Right (ARR). For these reasons, NFTs may be found for sale at more than just tech start-ups, and they are making their way into preeminent art institutions. Christie’s recently auctioned its first purely digital work (Beeple’s EVERYDAY-THE FIRST 5000 DAYS) with an accompanying NFT, shattering the record for a price paid for a digital work, with a stunning final hammer price of over $69 million.

Purchasers around the world are now competing to buy an unprecedented amount of digital artwork, memes, and GIFs minted as NFTs. This includes the famous Nyan Cat meme, which sold for nearly $600,000 in February 2021. In total, these sales have amounted to approximately $200,000,000 in the month of March 2021 alone, compared to $250,000 during the entire year of 2020. There is no limit to what can become an NFT; for example, a digital artwork based on Salvator Mundi (the painting controversially attributed to Leonardo da Vinci that shattered auction records when it sold for $450 million in 2017), called Salvator Metaversi, was recently turned into an NFT and placed on the market. It looks as though NFTs are here to stay, and some art market participants are hopeful that they will usher in a brave new era of digital and crypto-based art, helping the market recover from the pandemic-related recession.

Amineddoleh & Associates has been at the forefront of this burgeoning market, working on several cutting-edge matters involving NFTs. We have provided legal counsel to market leader NIFTY Gateway and MONAX, a digital contract management solution, which is launching a feature to wrap legal agreements around NFTs. Although NFTs present exciting new possibilities for artists and collectors, it is unclear how they will interact with existing legal regulations drafted with more traditional objects in mind. This is especially true of intellectual property (IP) law, including copyright and moral rights.

VARA Rights

Intellectual property rights are divided into economic rights and moral rights. Economic rights seek to protect a content creator’s ability to generate revenue based on their creations. For example, a publisher may be prohibited from selling copies of an author’s book without a license, thus depriving the author of revenue he or she is entitled to under copyright law. Moral rights seek to protect the intrinsic aspects of an artist’s creation and are more closely associated with honor and integrity rather than profit. For example, the French Supreme Court ruled in favor of director John Huston’s heirs, who argued that airing a colorized version of the classic silver screen film “The Asphalt Jungle” violated Huston’s moral rights. See Consorts John Huston vs Turner Entertainment Co., Cass., Ch. Civ. 1, May 28, 1991, n°89-19.522, n°89-19.725. In the United States, economic rights are protected by the Constitution and the Copyright Act, while moral rights are protected by the Visual Artists Rights Act (VARA), an act that was only passed in 1990. VARA solely applies to works of visual art and includes the following moral rights for artists: (1) the right to claim authorship of a work they created; (2) the right to disclaim authorship for a work they did not create; (3) the right to prevent the use of their name on any work that has been distorted, mutilated, or modified in a way that is prejudicial to the artist’s honor or reputation; and (4) the right to prevent the distortion, mutilation, or modification of a work that would prejudice the artist’s honor or reputation.

Intellectual property rights are divided into economic rights and moral rights. Economic rights seek to protect a content creator’s ability to generate revenue based on their creations. For example, a publisher may be prohibited from selling copies of an author’s book without a license, thus depriving the author of revenue he or she is entitled to under copyright law. Moral rights seek to protect the intrinsic aspects of an artist’s creation and are more closely associated with honor and integrity rather than profit. For example, the French Supreme Court ruled in favor of director John Huston’s heirs, who argued that airing a colorized version of the classic silver screen film “The Asphalt Jungle” violated Huston’s moral rights. See Consorts John Huston vs Turner Entertainment Co., Cass., Ch. Civ. 1, May 28, 1991, n°89-19.522, n°89-19.725. In the United States, economic rights are protected by the Constitution and the Copyright Act, while moral rights are protected by the Visual Artists Rights Act (VARA), an act that was only passed in 1990. VARA solely applies to works of visual art and includes the following moral rights for artists: (1) the right to claim authorship of a work they created; (2) the right to disclaim authorship for a work they did not create; (3) the right to prevent the use of their name on any work that has been distorted, mutilated, or modified in a way that is prejudicial to the artist’s honor or reputation; and (4) the right to prevent the distortion, mutilation, or modification of a work that would prejudice the artist’s honor or reputation.

One can imagine how NFTs may help enforce an artist’s economic rights: providing a record of ownership and the opportunity to attach specially contracted rights and obligations into the token (such as royalty rates) could make enforcement more efficient. However, it is less clear how NFTs will facilitate the enforcement of moral rights. In particular, the ability for NFTs to serve as incontrovertible proof of authorship, a chief benefit of NFTs, appears to be incompatible with rights allowing for conditional disavowal of an artist’s work.

Conventional VARA Rights Application

The third and fourth VARA rights, providing for the disavowal of a work that has been distorted, mutilated, or modified in a way that is prejudicial to the artist’s honor or reputation and for the prevention of such treatment, are sometimes the source of controversial litigation. In the US, moral rights are often seen as competing with traditional norms in property law, especially a subsequent owner’s ability to control his or her own property. Courts often face difficulty balancing intangible artists’ rights against real-world property rights, which has produced surprising results. Just as importantly, the art market is free to render its own decision concerning authorship and value, regardless of what a court of law might determine. The following examples illustrate how moral rights can be a double-edged sword in litigation.

Cady Noland, Log Cabin

Cady Noland, Log Cabin

Photo courtesy of Artnet

Celebrated American artist Cady Noland initiated a string of lawsuits against a collector and German gallery, most recently alleging that her rights under VARA were violated in a matter evoking a modern ship of Theseus. See Noland v. Janssen, No. 17-CV-5452 (JPO), 2020 U.S. Dist. LEXIS 95454 (S.D.N.Y. June 1, 2020). The work in question, Log Cabin, is a facade of a traditional log cabin created using pre-cut lumber ordered from a manufacturer in Montana. In 1955, the work’s then owner, Wilhelm Schürmann, loaned the work to a German museum, where it was displayed outdoors. Years later, several pieces of lumber began to rot and were replaced by conservators using lumber sourced from the same Montana manufacturer. Schürmann would go on to sell the work to Ohio collector Scott Mueller for $1.4 million, who had the foresight to include a buy-back option in the event the work was disavowed. Noland had already achieved some notoriety for disavowing works, which proved to be well-earned when she disavowed Log Cabin in a hand-written fax after learning of the conservation measures.

As one might expect when tempers run as high as sale prices, litigation ensued. Mueller sued the gallery for failing to return the purchase price, and the case was dismissed. See Mueller v. Michael Janssen Gallery PTE. Ltd., 225 F. Supp. 3d 201 (S.D.N.Y. 2016). But then Noland initiated a lawsuit of her own alleging the work infringed upon her copyright. Noland was granted leave to amend her complaint twice, with VARA violations added to her final amended complaint, but the litigation was ultimately dismissed. The judge concluded that Log Cabin was not entitled to copyright protection, and therefore not entitled to protections under VARA; and that in any case, any alleged violation occurred outside the United States. However, the case is just as notable for what it did not decide; namely, whether the unauthorized conservation of Log Cabin constituted a distortion, mutilation, or modification prejudicial to Noland’s honor as an artist. The absence of an answer has led some to question where the line might be drawn and may inspire future artists to make novel arguments along similar lines. As of 2020, Noland’s attorney was considering an appeal.

Richard Prince & Ivanka Trump

Appropriation artist Richard Prince, who has infamously tested the limits of copyright law on several occasions, ironically chose to exercise his VARA rights when he disavowed a work he sold to Ivanka Trump, apparently for political reasons. In a 2017 tweetreading, “This is not my work. I did not make it. I deny. I denounce. This fake art.” Prince publicly disavowed a work featuring his comment on one of Ivanka’s Instagram posts as part of his series “New Portraits.” The tweet followed a series of public statements criticizing Ivanka’s father, then presidential candidate, Donald Trump. The language of the tweet also appears to mimic Trump’s staccato speaking style and reference to “fake” claims. It is not clear whether the tweet would have become the subject of litigation, as Prince later confirmed in an interview that he voluntarily returned the $36,000 he initially received for the piece. Unfortunately, this leaves questions unanswered about under which conditions an artist may disavow an artwork and a disavowal’s effect on the market. In the absence of litigation, Prince’s actions set a non-legal precedent that an artist may disavow a work for political reasons if he or she has the cash on hand to reimburse the purchase price. In the end, Prince may have only increased the value of the work, still held by Ivanka, and whose creation by the artist is well-documented on Instagram.

5Pointz and Aerosol Art

5Pointz murals. Photo Pelle Sten, via Flickr.

Perhaps the most famous case involving the application of VARA involves graffiti mecca, 5Pointz. The Second Circuit Court of Appeals sent shockwaves through the world of copyright when it upheld a staggering $6.75 million damages award based on VARA violations for temporary works of street art. See Castillo v. G&M Realty L.P., 950 F.3d 155 (2d Cir. 2020). An abandoned warehouse in Queens was transformed into a graffiti mecca colloquially referred to as 5Pointz, a place where some of the city’s most notable (or notorious) street artists vied to make their own contributions to its decorated halls. The building’s owner, Gerald Wolkoff, initially welcomed their attention, and allowed artists to paint the walls under the direction of Jonathan Cohen, a graffiti artist known as Meres One, serving in a curatorial role. The matter was taken to court when Wolkoff wanted to take advantage of rising real estate prices and demolish the building to make way for condominiums. The artists, led by Cohen, protested the destruction, arguing that their works had achieved “recognized stature,” warranting protection under VARA. Then in 2013, while litigation was still pending, Wolkoff whitewashed the entire warehouse under the cover of night.

In 2018, Brooklyn Supreme Court Judge Frederick Block awarded the maximum statutory penalty under VARA, $150,000 per artwork, totaling nearly $7 million in damages. See Cohen v. G&M Realty L.P., 320 F. Supp. 3d 421 (E.D.N.Y. 2018).The 32-page decision was precedential in several ways. First, Judge Block vindicated street artists everywhere when he determined that these artworks had achieved a level of stature meriting copyright protection; in his analysis, he looked beyond the conventional art world for a group that venerated these works, and in doing so, opened the door for a dearth of unconventional art to receive legal protection. Perhaps most notably, the case was under close observation for its potential to establish a precedent for damages under VARA. Clearly influenced by Wolkoff’s surreptitious behavior, Judge Block’s decision to award the maximum penalty was still shocking. The case would work its way up the appellate ladder until finally being rejected for certiorari by the United States Supreme Court in 2020. The case now signals that VARA rights are not to be treated lightly and foretells the dire consequences that can result from a violation.

The above-mentioned disputes illustrate that moral rights cases are complex, and NFTs could further muddy the waters for judges unaccustomed to the peculiarities of the art market and crypto assets. At the moment, there is nothing preventing unscrupulous actors from minting NFTs of works and selling them as their own despite lack of good title, ownership, or IP rights. For instance, a so-called “market disruptor,” GlobalArtMuseum, carried out a “digital art heist” by creating NFTs of famous works held in top-tier museums, such as the Rijksmuseum. GlobalArtMuseum then placed the NFTs for sale on popular marketplace OpenSea. This was a publicity stunt, but nevertheless left the museums rattled. Similar acts could violate copyright law. Tracking down those responsible could prove complicated and the enforcement of legal remedies is not necessarily guaranteed. Online platforms operate across borders, so it may be difficult to determine which law applies, and countless transactions may occur in the meantime. Moreover, some lawyers are not convinced that NFTs qualify for copyright protection because it is an open question as to whether they are original works of authorship. Artists will need to keep this possibility in mind when minting NFTs and exerting moral and economic rights.

Another issue with NFTs pertains to ownership and the integrity of works. A self-proclaimed group of “tech and art enthusiasts” recently purchased a Banksy print, minted it as an NFT – and then burned the original. The group circulated the video of the burning print on YouTube, stating that “by removing the physical piece from existence and only having the NFT, [this]… will ensure that no one can alter the piece and it is the true piece that exists in the world.” This certainly raises the question of authenticity for NFTs when a physical work is also present; which is the original? If the physical work is mutilated or destroyed, but the NFT survives, how will this affect the damages an artist is entitled to receive under VARA? Hypothetically, Banksy could have a viable cause of action under VARA against the group, as his work is certainly of a recognized stature, but no court has ruled on the matter yet.

Conclusion

What does the NFT frenzy tell us? Art is constantly evolving, and the market is quick to adapt once supply and demand for new forms are established. NFTs are operating as a herald of such change, albeit at a much faster pace than anticipated. But this means that current legal and regulatory frameworks are not equipped to deal with some of the issues related to NFTs, including economic and moral rights. Artists entering the world of NFTs should be aware of these issues and consult legal professionals familiar with the pitfalls in this field. Amineddoleh & Associates is proud to represent and advise artists and collectors creating, selling, and purchasing all types of artwork and collectibles – NFTs included.

by Amineddoleh & Associates LLC | Mar 22, 2021 |

A rarely seen painting by Vincent van Gogh will be auctioned at Sotheby’s in Paris later this week. It is an appropriate venue for the sale of the work that depicts the Moulin de la Galette, a historic windmill in the Montmartre district of Paris. The work had been held within a French family’s private collection for over a century, and it is expected to fetch close to $10 million. Before it reaches the auction block, the work has already traveled to Amsterdam and Hong Kong where it went on public display.

A rarely seen painting by Vincent van Gogh will be auctioned at Sotheby’s in Paris later this week. It is an appropriate venue for the sale of the work that depicts the Moulin de la Galette, a historic windmill in the Montmartre district of Paris. The work had been held within a French family’s private collection for over a century, and it is expected to fetch close to $10 million. Before it reaches the auction block, the work has already traveled to Amsterdam and Hong Kong where it went on public display.

A perennial favorite of art lovers, Vincent van Gogh rose to great fame after his apparent suicide. His legacy was secured in large part thanks to the efforts of his sister-in-law Johanna Gezina van Gogh-Bonger, wife to his brother Theo. After Vincent’s death, his property passed to his younger brother. In turn, his brother passed to his property, including Vincent’s paintings and his correspondences to his wife. With no income and a child to feed, Johanna demonstrated a shrewd eye and a natural adeptness for managing her brother-in-law’s legacy, serving as art dealer, and promoting and caring for the works. Rather than simply sell works for the highest price, she made strategic donations to exhibitions to enhance the painter’s fame. In addition, she transcribed a Van Gogh family history by compiling and editing the brother’s correspondences. The publication of the letters helped spread the Romantic reputation of Vincent van Gogh as an emotional and suffering painter. Johanna played an important role in the artist’s legacy.

Keeping pace with the artist’s rising popularity, the value of Vincent van Gogh’s art rose dramatically decades after his death. Sales of his works through auction have broken records numerous times in the 1980s and the 1990s. Lawsuits concerning his works have made the news for decades now. Five years ago, the U.S. Supreme Court rejected the appeal of a man who sued Yale University as part of his bid to recover a $200 million van Gogh painting, The Night Café, from the institution. (The plaintiff alleged the painting was stolen from his family during the Russian Revolution; Yale has held the painting since 1961.) Only a few years earlier, the Supreme Court rejected another appeal seeking to divest actress Elizabeth Taylor of her van Gogh, View of the Asylum and Chapel at Saint-Remy, on the basis that a previous owner was coerced to sell the painting while fleeing Nazi Germany. With the values of the artist’s works in the millions, or even hundreds of millions of dollars, the stakes are high. Following these high-value ownership disputes, allegations of Nazi looting, and high-end forgery scandals, buyers are wise to complete due diligence prior to the acquisition of an artwork.

Keeping pace with the artist’s rising popularity, the value of Vincent van Gogh’s art rose dramatically decades after his death. Sales of his works through auction have broken records numerous times in the 1980s and the 1990s. Lawsuits concerning his works have made the news for decades now. Five years ago, the U.S. Supreme Court rejected the appeal of a man who sued Yale University as part of his bid to recover a $200 million van Gogh painting, The Night Café, from the institution. (The plaintiff alleged the painting was stolen from his family during the Russian Revolution; Yale has held the painting since 1961.) Only a few years earlier, the Supreme Court rejected another appeal seeking to divest actress Elizabeth Taylor of her van Gogh, View of the Asylum and Chapel at Saint-Remy, on the basis that a previous owner was coerced to sell the painting while fleeing Nazi Germany. With the values of the artist’s works in the millions, or even hundreds of millions of dollars, the stakes are high. Following these high-value ownership disputes, allegations of Nazi looting, and high-end forgery scandals, buyers are wise to complete due diligence prior to the acquisition of an artwork.

The painting for sale this month is recognized as one of van Gogh’s major works. The subject of the piece, the Moulin de la Galette, became popular during the 19th century for the brown bread it baked, which the windmill was later named after. As technology progressed to replace windmills, they became attractive tourist destinations for Parisians looking to enjoy a bucolic view amidst the urban landscape. The contrast between city and country clearly captured van Gogh’s attention, who began a series of works featuring the mill shortly after his arrival in Paris in 1887. Van Gogh was not the only artist inspired to capture its image; the windmill is featured in works by Pissarro, Utrillo, and in Renoir’s notable Bal du moulin de la Galette. Van Gogh’s rendition stands proudly among these works and has been featured in seven catalogues, although it has never been publicly exhibited—until now.

If you cannot make it to Paris, there are other ways to immerse yourself in van Gogh with the Van Gogh Experience in NYC this summer. This innovative exhibition uses 360º wall-sized projections to engage the viewer in van Gogh’s works from every angle. Similar versions of the exhibit can be found in many prominent cities across the country, including Los Angeles, Dallas, and Chicago. For an immersive experience that can be enjoyed from the comfort of home, fans might look to Loving Vincent, a 2017 movie depicted entirely in van Gogh’s signature painterly style. For a more conventional viewing, fans can turn to At Eternity’s Gate, a 2018 film for which Willem Dafoe received an Academy nomination for best actor based on his performance as van Gogh. And for purists, van Gogh’s most famous work, Starry Night, remains on permeant display at the Museum of Modern Art in NYC.

Amineddoleh & Associates LLC has previously worked with a well-known international collector to assist in the authentication of a van Gogh work in his collection. Through this process, we have corresponded with the Van Gogh Museum, and collaborated with provenance investigators and forensic scientists. We continue working with experts to authenticate our clients’ collections or assist them with due diligence prior to a purchase.

Join our founder and other experts for an important event addressing the effects of international sanctions on the preservation and protection of cultural heritage. Iran’s astounding cultural heritage has developed over many millennia. But during the past decade, Iranian heritage has had to contend with the sanctions era, a period in which political and practical challenges have made heritage management, research, and cultural tourism more difficult. In this unique webinar hosted by the Heritage Management Organization and the Bourse & Bazaar Foundation, these challenges will be discussed by experts with first-hand knowledge of how Iran’s cultural sector has had to adapt in order to remain connected to global exchanges on arts, culture, and shared patrimony.

Join our founder and other experts for an important event addressing the effects of international sanctions on the preservation and protection of cultural heritage. Iran’s astounding cultural heritage has developed over many millennia. But during the past decade, Iranian heritage has had to contend with the sanctions era, a period in which political and practical challenges have made heritage management, research, and cultural tourism more difficult. In this unique webinar hosted by the Heritage Management Organization and the Bourse & Bazaar Foundation, these challenges will be discussed by experts with first-hand knowledge of how Iran’s cultural sector has had to adapt in order to remain connected to global exchanges on arts, culture, and shared patrimony.

Intellectual property rights are divided into economic rights and moral rights. Economic rights seek to protect a content creator’s ability to generate revenue based on their creations. For example, a publisher may be prohibited from selling copies of an author’s book without a license, thus depriving the author of revenue he or she is entitled to under copyright law. Moral rights seek to protect the intrinsic aspects of an artist’s creation and are more closely associated with honor and integrity rather than profit. For example, the French Supreme Court

Intellectual property rights are divided into economic rights and moral rights. Economic rights seek to protect a content creator’s ability to generate revenue based on their creations. For example, a publisher may be prohibited from selling copies of an author’s book without a license, thus depriving the author of revenue he or she is entitled to under copyright law. Moral rights seek to protect the intrinsic aspects of an artist’s creation and are more closely associated with honor and integrity rather than profit. For example, the French Supreme Court

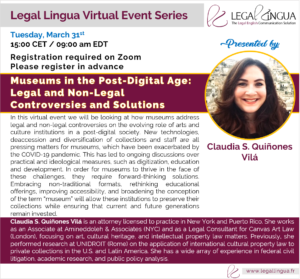

Associate Claudia Quinones will be presenting a free lecture, “Museums in the post-digital age” on March 31 at 9 am EST. The talk will explore the evolution of museums according to new technological developments and an expansive view of these institutions’ social roles. Claudia will analyze the International Council of Museums (ICOM)’s proposed definition of the term “museum” to provide a framework for discussion, and she will examine how rapid changes in the art market and the COVID-19 pandemic have exposed weaknesses in the current institutional system. Register here:

Associate Claudia Quinones will be presenting a free lecture, “Museums in the post-digital age” on March 31 at 9 am EST. The talk will explore the evolution of museums according to new technological developments and an expansive view of these institutions’ social roles. Claudia will analyze the International Council of Museums (ICOM)’s proposed definition of the term “museum” to provide a framework for discussion, and she will examine how rapid changes in the art market and the COVID-19 pandemic have exposed weaknesses in the current institutional system. Register here:  A rarely seen painting by Vincent van Gogh will be auctioned at

A rarely seen painting by Vincent van Gogh will be auctioned at  Keeping pace with the artist’s rising popularity, the value of Vincent van Gogh’s art rose dramatically decades after his death. Sales of his works through auction have broken records numerous times in the 1980s and the 1990s. Lawsuits concerning his works have made the news for decades now. Five years ago, the U.S. Supreme Court

Keeping pace with the artist’s rising popularity, the value of Vincent van Gogh’s art rose dramatically decades after his death. Sales of his works through auction have broken records numerous times in the 1980s and the 1990s. Lawsuits concerning his works have made the news for decades now. Five years ago, the U.S. Supreme Court  Our founder, Leila A. Amineddoleh, will be speaking at a conference organized by the Hellenic Committee of the Blue Shield in collaboration with the University of Nicosia and the National and Kapodistrian University of Athens. The talk will address the repatriation of antiquities from the United States to their origin nations. Please register at

Our founder, Leila A. Amineddoleh, will be speaking at a conference organized by the Hellenic Committee of the Blue Shield in collaboration with the University of Nicosia and the National and Kapodistrian University of Athens. The talk will address the repatriation of antiquities from the United States to their origin nations. Please register at