by Amineddoleh & Associates LLC | Jun 14, 2021 |

Virtual restoration of the Old Summer Palace during the Qing Dynasty, 1644-1911. (Copyright: Asianewsphoto)

Over two thousand years ago, the Jade Emperor, Supreme God of the Heavens in Taoism mythology, launched what is now known as the Great Race. The invitation was extended to every animal species in the Empire but, because of prior engagements or travel restrictions, only twelve (the Pig, Rooster, Sheep, Horse, Dog, Monkey, Snake, Rabbit, Dragon, Tiger, Rat, and Ox) attended the event. In gratitude, the Jade Emperor promised each participant it would be attributed a zodiac year and two hours of the day. The first to reach the finish line would become the first zodiac sign and the first two hours of the day, and so on. The race crossed all terrains, with its climax being a river crossing. Rat, the group’s smallest member, feared for its life; until it spied Ox. The bovine was known to have poor vision so Rat offered to direct it through the river by riding on its back. Ox agreed and they began the final leg of the journey. Yet once the pair grew close to the opposite bank, Rat jumped off Ox’s head and won the race. To this day, Rat remains the first sign in the Chinese zodiac and it symbolizes hours 11:00pm to 1:00am.

Under the Qing dynasty in the 18th century, Emperor Qianlong commissioned the creation of the Old Summer Palace in Beijing. Reigning over 715 acres of utopian hills and gardens, the palace hosted the empire’s formal and recreational stays. Within this land, hidden in the Garden of Eternal Spring, was the Haiyantang water-clock fountain. Giuseppe Castiglione, an Italian painter, designed the fountain to include twelve bronze heads in the shapes of the zodiac animals, which sprouted water at the hours to which the creatures were assigned in the Great Race myth. Water speared out of Rat’s mouth at midnight and Rabbit rose with the sun from 5:00 to 7:00am.

In 1856, the British declared the Second Opium War against the Qing government. The French joined soon after. Four years into the war, British High Commissioner to China, James Bruce, the Eight Earl of Elgin entered the picture. The son of the Thomas Bruce (known for removing from marble frieze from the Parthenon), James Bruce ordered the burning and looting of the Old Summer Palace. Like his father, James has faced the ire of history due to his destruction and theft of a nation’s heritage. He knew that amongst the Chinese Palace’s treasures, the fountain’s bronze heads were no small catch. The French and British soldiers likely traded some of the loot amongst themselves. We now know most of the bronze heads were sent to Europe.

In 1856, the British declared the Second Opium War against the Qing government. The French joined soon after. Four years into the war, British High Commissioner to China, James Bruce, the Eight Earl of Elgin entered the picture. The son of the Thomas Bruce (known for removing from marble frieze from the Parthenon), James Bruce ordered the burning and looting of the Old Summer Palace. Like his father, James has faced the ire of history due to his destruction and theft of a nation’s heritage. He knew that amongst the Chinese Palace’s treasures, the fountain’s bronze heads were no small catch. The French and British soldiers likely traded some of the loot amongst themselves. We now know most of the bronze heads were sent to Europe.

World-renowned French fashion designer Yves Saint Laurent and his partner Pierre Bergé spent years acquiring an enviable art collection. From their first acquisition of a wooden bird sculpture, Oiseau Sénoufo, originating from Côte d’Ivoire in 1960, animals became a central theme in their collection. When Saint Laurent died in 2008, Bergé auctioned off a large part of their collection with Christie’s Paris the following year. Up for auction were the rat and rabbit heads. They may have gone unnoticed, but the Republic of China had had its eyes out for the bronzes for nearly a decade. Back in 2000 the tiger, the monkey, and the ox were the first zodiac heads to reappear on the public art market. At the time, they were featured in Christie’s and Sotheby’s auction catalogues for their upcoming sales. The Chinese State Bureau of Cultural Relics promptly wrote to the auction houses demanding the withdrawal of the bronze heads from the sales. The Chinese government did not formulate an official restitution request because international conventions were viewed as inapplicable to lootings that occurred over 140 years ago. As a result, the auction houses rejected the State’s request. In an unexpected turn of events, however, China Poly Group Corp. Ltd.placed its live bids on all three heads, and won them for a total of $4 million dollars. The sculptures were placed in this state-owned corporation’s Poly Art Museum in Beijing, which is dedicated to Chinese heritage. Three years later, the same museum acquired the pig head from Chinese billionaire Stanley Ho, who had bought it from a New York collector. Finally, in 2007, Ho purchased the horse head from Sotheby’s Hong Kong for $8.9 million dollars.

Jackie Chan wrote, directed, and starred in a film about the stolen zodiac bronzes.

It came as no surprise when Christie’s Paris received a letter from the Chinese government in February 2009 asking that the rat and rabbit heads be removed from the Yves Saint Laurent-Bergé sale. It was also to be expected that the auction house would refuse. In protest, the “Association pour la protection de l’art chinois en Europe” (the Foundation for the protection of Chinese art in Europe) along with eighty other Chinese lawyers, filed a complaint with the “juge des référés” whose role in France is to deliver temporary restraining orders in time-sensitive situations. Two days before auction, the tribunal rejected the foundation’s request to enjoin the sale.

THE PROVENANCE: In its press release on the three-day Saint Laurent estate sale, Christie’s described the zodiac bronze heads as the “two main pieces” amongst the works for sale. The sculptures’ provenance revealed that Saint Laurent had acquired them from the Kugel brothers at their famous Galerie Kugel in Paris. The Kugels bought the bronze heads from the marquis de Pomereu in 1986 who had attained them from the Spanish painter José María Sert.

On the closing day of the sale, February 25, 2009, the rat and rabbit bronzes sold for the equivalent of nearly $40 million. A few days later, the winning bidder refused to pay for them. Cai Mingchao, a self-described Chinese patriot, explained his act was a national duty. “This money,” he claimed, “should not be paid.” The Chinese government publicly supported Mingchao’s fraud and, in addition, placed tighter trade restrictions on Christie’s art trades, ordering local law enforcement officials to report any artifact that might have been looted and trafficked. Following Mingchao’s refusal to pay for the sculptures, Pierre Bergé eventually sold the lots to French billionaire François Pinault, the owner of Christie’s.

Rabbit bronze for auction at Christie’s (Copyright: Agence France-Presse)

However, the story was not over. In 2013, Pinault announced that the rat and rabbit heads would return to Beijing. But the animals’ race home came at a price. Curiously, this donation occurred only a few days after Christie’s was granted a license to conduct business on mainland China. Most recently, in December 2020, China’s National Cultural Heritage Administration launched the return of the horse head. The Summer Palace was restored in 1886, twenty-six years after its destruction. However, the dragon, dog, sheep, snake, and rooster have yet to reach to finish line and return home.

by Amineddoleh & Associates LLC | Jun 10, 2021 |

The Rumor Circuit, 2004

At Amineddoleh & Associates, we are proud to represent many talents. Amongst them is visual artist Kamrooz Aram. His current group shows at Peter Blum Gallery in New York, NY, and Z33 in Hasselt, Belgium, give us the opportunity to highlight his work and career.

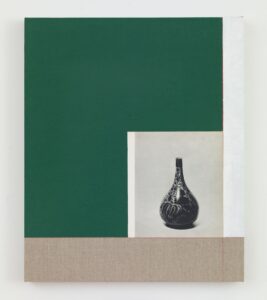

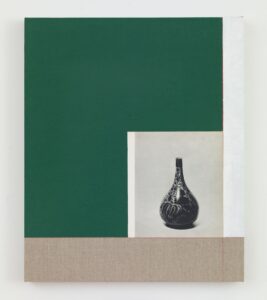

Based in Brooklyn, NY, Aram was born in Shiraz, Iran. He received a BFA from Maryland Institute’s College of Art and an MFA from Columbia University. His work questions the complex relationship between ornament and the so-called decorative arts and Modernism. He also engages architecture through painting and exhibition design by using physical spaces in his art. In his current two-person exhibit at Z33, Lives of Forms, Aram and his colleague Iman Issa use the gallery space as a tool to expand their work. In Luster on Blue Glaze (2021), Aram’s small painting of a Middle Eastern vase is framed by small geometric shapes of mat colors, with the vase collaged from a book documenting Iranian ceramics. The ensemble is surrounded by a scarlet red wall. The viewer’s eyes are caught between the artifact’s delicacy and timelessness, at the center, and the contrasting grandiosity of modern abstraction.

Untitled (Arabesque Composition), 2021

Field of Vision, at Peter Blum Gallery, like Lives of Forms, include some of Aram’s Arabesques compositions. The term Arabesque, according to Aram, has several definitions. The most common refers to the leafy and floral forms that might ornament a carpet or a tiled wall. The word’s etymology suggests a form that is Arab-like. The term was created by Europeans. At first glance, his Arabesque series represents large floral grids surrounded by a border. However, just like Luster on Blue Glaze’s play on space, the Arabesques’ borders become part of the grid. The frame and the enclosed content merge into a singular composition. The exposed grid lines and the artist’s visible strokes add an organic element to the works. This technique also gives the impression that the paintings are worn by time and have survived from a different era. Aram uses a variety of mediums, including oil, acrylic, and wax pencil.

Luster on Blue Glaze, 2021

Aram’s work has been acquired by well-known public collections, including the Metropolitan Museum of Art, New York; the Cincinnati Art Museum, Ohio; the Modern Art Museum of Fort Worth, Texas; and M+, Hong Kong. He has been featured in solo and group exhibitions throughout the world, including in New York, Dubai, Belgium, Texas, and Chicago. He was awarded the Abraaj Group Art Prize (2014) and has won grants from Art Matters, the New York Foundation for the Arts, and the Jacob K. Javits Fellowship Program. His work has been reviewed in Art in America, Artforum.com, The New York Times, Asian Art Newspaper, ArtReview, The Village Voice, the Wall Street Journal, and the arts and culture segment on BBC Persian: Tamasha.

Field of Vision is on view at Peter Blum Gallery through July 30, 2021.

Lives of Forms is on view at Z33 through August 1, 2021.

For press inquiries or questions about Aram’s work, please contact the artist at kamroozaram.studio@gmail.com

by Amineddoleh & Associates LLC | May 24, 2021 |

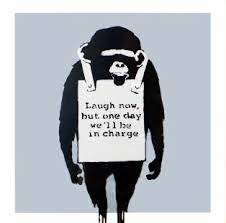

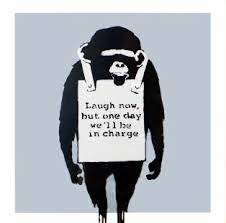

Banksy’s Laugh Now graffiti predicted a role inversion. On Thursday, May 18th, the Cancellation Division of the European Union Intellectual Property Office (EUIPO) invalidated a trademark on the street artist’s image of a monkey wearing the sign “Laugh now, but one day we’ll be in charge.” This was the EUIPO’s second invalidation of a Banksy trademark in less than a year.

Banksy, Rage, Flower Thrower (2003). Image Courtesy of Lazinc

Back in 2014, Pest Control Office Ltd. a company that acts on Banksy’s behalf to maintain his anonymity, registered a trademark of the artist’s Rage, Flower Thrower graffiti. Because Full Colour Black, a British art licensing company specialized in the printing of street art, was determined to sell greeting cards illustrating Flower Thrower, the company challenged the registration claiming bad faith under Article 59(1)(b) of the EU Trade Mark Regulation. Full Black Colour argued that Banksy never intended to use the mark. Rather, it claimed that Banksy had registered it to maintain full control over the use of his images and to continue to grant regular copyright licenses. Full Black Colour demonstrated Banksy’s aversion to copyright law by referring to the artist’s public claim that “Copyright is For Losers©TM”.

On September 14, 2020, the Cancellation Division aligned with Full Black Colour and invalidated the artist’s trademark: “It must be pointed out that…[Banksy] cannot be identified as the unquestionable owner of such works as his identity is hidden; it further cannot be established without question that the artist holds any copyrights to a graffiti. The contested EUTM was filed in order for Banksy to have legal rights over the sign as he could not rely on copyright rights, but that is not a function of a trademark.”

Banksy, Laugh Now (2005). Courtesy Artsy

In the meantime, Full Black Colour had filed a second complaint before the EUIP to invalidate Banksy’s trademark of Laugh Now on the same legal grounds. On May 18, 2021, the artist argued that the claimant had not provided sufficient evidence to prove bad faith. Banksy referred to the Court of Justice of the European Union’s C-371/18 judgement (2020), in which the Court had held that invalidation for bad faith is appropriate when the trademark was filed “with the intention of undermining, in a manner inconsistent with honest practices, the interests of third parties or with the intention of obtaining…an exclusive right for purposes other than those falling within the functions of a trade mark.” (§74). Banksy also raised the interesting argument that, under Article 11.1 of the EU Charter of Fundamental Rights, which protects freedom of expression, he could not lose the right to file a trademark on the basis that he had previously claimed that copyright is for losers. Moreover, Banksy explained his comment “was clearly ironic as it was accompanied by both a copyright and trade mark symbol.” Finally, the artist recalled that in Creative Foundation v. Dreamland Leisure Ltd. (2015), which concerned Banksy’s entitlement to copyright protection as a street artist, the English High Court’s Chancery Division held that trademarks and copyrights are not exclusive. Banksy argued that his refusal to copyright Laugh Now did not disqualify his trademark registration.

Once again, however, the EUIPO aligned with Full Black Colour. The Cancellation Division found that Banksy did not use any of his registered marks as trademarks. Instead, it held that his trademarks were an attempt to monopolize images on an indefinite basis, and that his EU trademark was filed to circumvent copyright law, amounting to bad faith. Who’s laughing now?

by Amineddoleh & Associates LLC | May 17, 2021 |

Wave Amnesia by Kate McQuillen

On view at Massey Klein Gallery until Saturday, June 19th.

On Friday, May 7th, visual artist Kate McQuillen’s first New York City solo show opened at Massey Klein Gallery. The exhibition, titled Wave Amnesia, was officially launched with a reception on Sunday, May 9th.

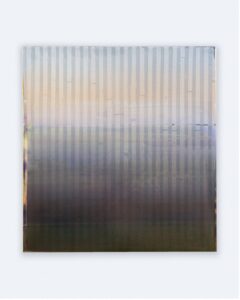

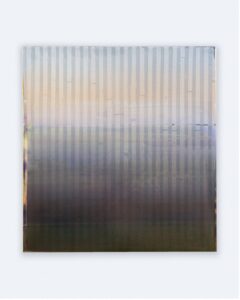

McQuillen’s work is sometimes described as “hyper-flat” for its indiscernible texture and brushstrokes. She creates transparent color gradients by applying thin layers of acrylic paint through silkscreen, producing an imagery that sometimes recall the light displays of auroras borealis. The paintings’ impenetrable matte surfaces allow viewers to experience them without external distractions.

The works in Wave Amnesia depict the human mind’s imperfection. McQuillen was inspired by confusing mental experiences such as the combination of emptiness and abstract imagery that occurs in the brain when a word is forgotten or is about to be recalled. These moments can cause the mind to be caught in limbo between knowledge and oblivion. McQuillen’s work seeks abstract imagery that communicates this same experience of that which is familiar but still unknown. The show is counterbalanced by two distinct styles. The first is marked by repetitive and linear layers of paint that hide the artist’s hand almost entirely. The second contrasts with the first by exposing the unevenness of the creative process. Wave Amnesia was influenced by artists such as Jacqueline Humphries, Charline von Heyl, and Joan Mitchell.

McQuillen’s work has been exhibited nationally and abroad. She has been featured in international art fairs in Toronto (Canada) and Chicago. The artist lives and works in Brooklyn, NY.

Massey Klein Gallery is located at 124 Forsyth St. New York, NY 10002.

For press inquiries or questions about works available, please contact ryan@masseyklein.com.

Borderlands, acrylic on panel, 51″ x 48,” 2021

by Amineddoleh & Associates LLC | May 10, 2021 |

Fondation pour le droit de l’art

Last week, our founder Leila Amineddoleh spoke at an event hosted by the Art Law Foundation titled Non-Fungible Tokens in the art market: the beginning of a digital art boom? The event was organized and moderated by attorney Anne-Laure Bandle, Director of the Art Law Foundation and co-founder of the Responsible Art Market initiative. Other panelists included Gabriel Jaccard, a legal scholar in the field of smart contracts and Co-Chair of the Regulatory Working Group Crypto Valley, and Garrett Landolt, a Postwar and Contemporary Art Specialist at Christie’s auction house. This multidisciplinary group of speakers presented varying perspectives on NFTs and the art market, demystifying this new asset class for the audience.

After Gabriel explained the technological aspects of NFTs, Leila stressed the importance of understanding and drafting contractual terms relating to them. As digital assets, NFTs fall outside traditional frameworks of property law and art sales agreements. In conventional transactions, a buyer will purchase a work from an artist or on the secondary market and receive a tangible object. With NFTs, it is not always immediately clear what the collector is buying or what rights they will be allowed to retain and exercise. A digital token can exist separately from a physical work of art or contain rights to a unique digital artwork that does not have a physical counterpart. Each situation will carry different rights for the creator, the seller, and the purchaser. For instance, a variety of options are available for the protection of artists’ moral and intellectual property rights, although this is complicated by the fact that such rights vary between countries. (A prior blog post examines moral rights and NFTs.) As this is a rapidly developing field, contracts will need to adapt to the rapidly changing technology and art market.

Gabriel noted that NFT sales are governed by smart contracts embedded within the purchased tokens that are programmed to operate automatically. (These contracts work similarly to a vending machine, which is programmed to release an item when a buyer inserts payment). However, as NFTs are a recent addition to the legal world and are usually more expensive than chips and soda, parties are still struggling with how to draft contractual terms that program the tokens effectively. Without clear legal precedent to inform these agreements, questions have arisen as to how the trade in these assets will develop. Depending upon the limitations the seller wishes to place on the NFT (such as commercial use and publicity restrictions), the parties may approach sales as straightforward exchanges of goods, as more complex licensing agreements, or even as hybrid contracts that incorporate these two forms. In any case, the parties’ rights should be clearly specified and memorialized in an agreement in order to avoid future legal challenges. Another critical matter to consider is the potential conflict between private contract provisions and the terms of services on an NFT platform. Although it is unclear which terms will prevail in the event of a dispute, including protections in the agreement will help safeguard the parties and help enforce their rights.

Source: Christie’s

As a complement to the legal discussion, Garrett provided an exclusive account of the now famed March 2021 Beeple sale, which drew 22 million visitors to Christie’s website during the final minutes of the auction. This unprecedented traction perhaps suggests that NFTs are a more desirable (or at least more accessible) asset class for Millenials than the traditional art market sphere: bidders for Beeple’s “Everydays” averaged 36 years old. Garrett also indicated that while Christie’s had an excellent start, this sale was a learning experience for future transactions. The auction house plans to pursue NFT sales and will offer blockchain-embedded works called Cryptopunks in an upcoming auction. It remains to be seen whether NFTs will be treated as a luxury asset, but Christie’s will remain selective with the items chosen for auction.

As part of the event, Anne-Laure then moderated audience questions. The first question concerned recommendations for potential purchasers. All the panelists agreed that purchasers should perform due diligence in advance of transactions to ensure that they fully understand what is being purchased, their respective rights, liabilities, and potential legal implications. Proceeding with caution is necessary to avoid pitfalls. Gabriel further noted that purchasers should verify whether the relevant contract addresses their needs, depending on the purpose of the transaction (investing versus collecting). Another question concerned the reception of NFTs by financial institutions as collateral for loans. Gabriel stated that NFTs currently represent a high-risk ratio and as such, financial institutions are hesitant to use them as collateral. However, this could change in the future if NFT-related transactions become more common, and smart contracts could potentially be used as collateral. It is worth noting that financial institutions must also comply with anti-money laundering (AML) regulations, which were recently extended to antiquities dealers in the US and already apply to art market participants in the EU and UK. If financial institutions apply the new regulations to NFT transactions, these institutions will need to conduct diligence regarding the identity of the work’s ultimate beneficial owner. This requirement might mitigate the anonymity provided by the Internet and ultimately discourage certain NFT buyers.

The legal landscape surrounding NFTs continues to develop. Collectors, artists, and other art market participants are wise to obtain legal counsel from experienced professionals with an understanding of this new asset class. At Amineddoleh & Associates, we have a strong track record representing artists, collectors, and galleries at all stages of art transactions. We have served as legal advisors on a number of high-profile NFT transactions, and we are currently working with Nifty Gateway and Monax, as well as with artists and their estates. We relish the opportunity to continue work in this developing area. We are proud to be at the forefront of legal work for this exciting new asset in the digital, artistic, and legal fields.

In 1856, the British declared the Second Opium War against the Qing government. The French joined soon after. Four years into the war, British High Commissioner to China, James Bruce, the Eight Earl of Elgin entered the picture. The son of the Thomas Bruce (known for removing from marble frieze from the Parthenon), James Bruce ordered the burning and looting of the Old Summer Palace. Like his father, James has faced the ire of history due to his destruction and theft of a nation’s heritage. He knew that amongst the Chinese Palace’s treasures, the fountain’s bronze heads were no small catch. The French and British soldiers likely traded some of the loot amongst themselves. We now know most of the bronze heads were sent to Europe.

In 1856, the British declared the Second Opium War against the Qing government. The French joined soon after. Four years into the war, British High Commissioner to China, James Bruce, the Eight Earl of Elgin entered the picture. The son of the Thomas Bruce (known for removing from marble frieze from the Parthenon), James Bruce ordered the burning and looting of the Old Summer Palace. Like his father, James has faced the ire of history due to his destruction and theft of a nation’s heritage. He knew that amongst the Chinese Palace’s treasures, the fountain’s bronze heads were no small catch. The French and British soldiers likely traded some of the loot amongst themselves. We now know most of the bronze heads were sent to Europe.