by Amineddoleh & Associates LLC | Oct 29, 2021 |

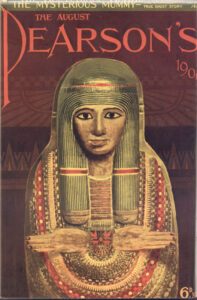

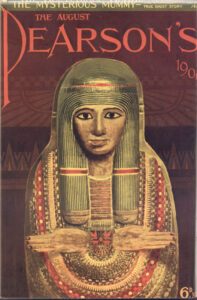

Cover of 1909 Pearson’s Magazine featuring the Unlucky Mummy

Just in time for Halloween, this spooky entry in our Provenance Series explores the strange case of the “Unlucky Mummy,” an ancient Egyptian artifact held by the British Museum since 1889 and rumored to have played a part in several tragic events during the last 150 years. The name of the object is misleading, as it is not an actual mummy, but rather a painted wooden “mummy board” or inner coffin lid depicting a woman of high rank. Mummy boards were placed on top of mummies, covered in plaster, and decorated elaborately with protective symbols of rebirth. The Unlucky Mummy was discovered in Thebes, an ancient hub for religious activity and the site of a renowned necropolis. It dates back to 950-900 B.C.E. While the lid does contain hieroglyphic inscriptions, these only refer to religious phrases; the identity of the deceased remains unknown. In the early 1900s, British Museum specialists believed that she may have been a temple priestess or a member of the royal family, but this was never confirmed by supporting evidence.

According to the museum’s records, the mummy board was originally acquired by an English traveler in Egypt during the 1860s-1870s. The mummy itself was most likely left in Egypt, since it has never formed part of the British Museum’s collection. The traveler was part of a group of Oxford graduates touring Luxor, who drew lots to haggle over the coffin lid. All four companions suffered unfortunate fates soon after this purchase. One of the men disappeared into the desert, one was accidentally shot by a servant and had his arm amputated, one lost his entire life’s savings, and one fell severely ill and was reduced to poverty. The mummy board then passed to the sister of one of the men, Mrs. Warwick Hunt, whose household became plagued by a series of misfortunes. When Mrs. Hunt attempted to have the coffin lid photographed in 1887, the photographer and porter both died, and the man hired to translate the hieroglyphs committed suicide. Clairvoyant Madame Helena Blavatsky allegedly detected an evil influence emanating from the mummy board, and convinced Mrs. Hunt to dispose of the object by donating it to the British Museum. Yet tales of the curse would follow. In 1904, journalist Bertram Fletcher Robinson published an article in the Daily Express titled “A Priestess of Death,” detailing the mummy board’s grisly exploits. When he died suddenly three years later, this was attributed to the Unlucky Mummy’s vengeance from beyond the grave. Even Sir Arthur Conan Doyle, the creator of Sherlock Holmes and avowed spiritualist, claimed that the mummy’s spirit had used “elemental forces” to strike down Robinson.

One of the more sensational stories is that the mummy board was on the SS Titanic in 1912 and caused the ship to sink. However, this is only a rumor; the Unlucky Mummy has been on public display since the 1890s, except during WWI and WWII when it was placed in storage for safekeeping. It first left the British Museum in 1990 for a temporary exhibition at the National Gallery of Australia, and it made it back to London safe and sound. In fact, much of the mummy’s malevolent backstory was invented by English editor William T. Stead, who possessed a fascination with the supernatural. Ironically, Stead perished on the Titanic – but the Unlucky Mummy’s legacy lives on. It is allegedly responsible for multiple murders, illnesses, injuries, hauntings, eerie noises, flickering lights, and other suspicious activity.

One of the more sensational stories is that the mummy board was on the SS Titanic in 1912 and caused the ship to sink. However, this is only a rumor; the Unlucky Mummy has been on public display since the 1890s, except during WWI and WWII when it was placed in storage for safekeeping. It first left the British Museum in 1990 for a temporary exhibition at the National Gallery of Australia, and it made it back to London safe and sound. In fact, much of the mummy’s malevolent backstory was invented by English editor William T. Stead, who possessed a fascination with the supernatural. Ironically, Stead perished on the Titanic – but the Unlucky Mummy’s legacy lives on. It is allegedly responsible for multiple murders, illnesses, injuries, hauntings, eerie noises, flickering lights, and other suspicious activity.

For those who wish to see the Unlucky Mummy in person, it is currently located in Room 62 of the British Museum. Hopefully, its curse won’t follow you home…

by Amineddoleh & Associates LLC | Oct 26, 2021 |

Today, the Gilbert Trust for the Arts in London announced the return a 4,250-year-old Anatolian gold ewer from the Gilbert Collection to Turkey. The Gilbert Collection was created by Arthur Gilbert (1913-2001), who amassed an outstanding collection of British and European decorative arts that is currently on long-term loan to the Victoria & Albert Museum (the V&A). Unbeknownst to Gilbert, the ewer was the product of illegal excavation and export. This came to light in 2019, after the Gilbert Trust for the Arts, which is responsible for managing the collection, performed an extensive provenance research project revealing the ewer’s connection to an unscrupulous antiquities dealer who concealed its true origins. Our founder, Leila A. Amineddoleh, played a role during this process as she shared her expertise in repatriation matters with the Gilbert Trust’s researchers and provided advice on what approach to adopt (based on legal and ethical grounds).

Today, the Gilbert Trust for the Arts in London announced the return a 4,250-year-old Anatolian gold ewer from the Gilbert Collection to Turkey. The Gilbert Collection was created by Arthur Gilbert (1913-2001), who amassed an outstanding collection of British and European decorative arts that is currently on long-term loan to the Victoria & Albert Museum (the V&A). Unbeknownst to Gilbert, the ewer was the product of illegal excavation and export. This came to light in 2019, after the Gilbert Trust for the Arts, which is responsible for managing the collection, performed an extensive provenance research project revealing the ewer’s connection to an unscrupulous antiquities dealer who concealed its true origins. Our founder, Leila A. Amineddoleh, played a role during this process as she shared her expertise in repatriation matters with the Gilbert Trust’s researchers and provided advice on what approach to adopt (based on legal and ethical grounds).

As a result of its discussions with the Turkish Ministry of Culture, the Gilbert Trust officially donated the ewer to the Museum of Anatolian Civilizations in Ankara and commissioned a leading contemporary metalsmith to create a piece addressing the object’s history, to be displayed at the V&A in December. This recreation will allow the ewer to remain present in the museum’s galleries and initiate a constructive dialogue on the importance of proactive provenance research, collaboration, and exchange. While other institutions are sometimes wary of repatriating objects without a legal requirement to do so, the Gilbert Trust’s actions demonstrate that it is possible to return cultural objects in a way that is both respectful to current possessors and takes the source country’s wishes into consideration, leading to a mutually beneficial solution.

The Ewer’s Provenance

Not only is the ewer a stunning example of ancient metalwork, it also possesses a fascinating history. This masterpiece was created by a Hattian goldsmith living in Anatolia over 4,000 years ago. The ewer was formed by embossing a single sheet of gold with complex patterns, including an ancient symbol of the sun, in order to accompany a Hattian ruler into the afterlife. When Gilbert acquired the ewer in 1989, he was dazzled by the evocative story as well as its beauty. However, because Gilbert was not very experienced in collecting these types of objects (this was the only archaeological object he ever bought), the seller was able to conceal the ewer’s illicit origins and misrepresent the origins of the piece.

Not only is the ewer a stunning example of ancient metalwork, it also possesses a fascinating history. This masterpiece was created by a Hattian goldsmith living in Anatolia over 4,000 years ago. The ewer was formed by embossing a single sheet of gold with complex patterns, including an ancient symbol of the sun, in order to accompany a Hattian ruler into the afterlife. When Gilbert acquired the ewer in 1989, he was dazzled by the evocative story as well as its beauty. However, because Gilbert was not very experienced in collecting these types of objects (this was the only archaeological object he ever bought), the seller was able to conceal the ewer’s illicit origins and misrepresent the origins of the piece.

In fact, Bruce McNall – the antiquities dealer who sold the work to Gilbert – later admitted to smuggling ancient artifacts out of source countries like Italy, Greece and Turkey. He worked alongside his partner, Robert E. Hecht, to sell items to unsuspecting buyers. McNall is a colorful figure who once owned Thoroughbred racehorses as well as sports teams (the Los Angeles Kings of the National Hockey League and the Toronto Argonauts of the Canadian Football League), enjoying a great deal of commercial success. However, his fall from grace in the early 1990s after defaulting on a $90 million loan resulted in bankruptcy and a 6-year stint in prison. McNall’s autobiography, published in 2003, details his partnership with Hecht and offers a glimpse into the world of illicit antiquities trafficking. According to the book, at one point Hecht occupied the dubious honor of being the world’s largest source of recently discovered antiquities, which he was able to procure thanks to monetary resources and an extensive network of grave robbers, smugglers, and intermediaries. Once items were obtained, they passed through countries without export controls and then onto Hecht, who sold them on to a collector or dealer. In order to sell the illusion that an item’s provenance was above board, Hecht would spin tales about its location in private homes and the like for the past several decades. As his reputation – and notoriety – increased, buyers would come to Hecht knowing that he could procure rare and valuable pieces. This included McNall, who later opened a gallery on Rodeo Drive in Los Angeles supplied mainly by Hecht’s dubious dealings. Both men drove the market for ancient art amongst the wealthy, creating false sales receipts and invoices from foreign-based companies (usually set up by McNall and Hecht) to cover their tracks.

Notably, Hecht was also tied to the Euphronios Krater later returned to Italy by the Metropolitan Museum of Art. In 2005, Hecht was charged with trafficking in looted antiquities alongside former Getty Museum curator Marion True and Italian dealer Giacomo Medici, but the case was dismissed in Italian court because the statute of limitations expired before the verdict was issued. He moved to Paris in the wake of the scandal, where he eventually passed away in 2012 – although his legacy lives on in the remaining looted objects that passed through his hands and are dispersed throughout the world.

The Importance of Provenance Research

During the period when McNall and Hecht were active, provenance research was not given the same importance it holds today. For the majority of purchasers, including museums, not asking in-depth questions about provenance or looking the other way when confronted with suspicious ownership histories was considered the norm. However, nowadays museums and private collectors increasingly acknowledge the crucial role of provenance research in upholding the legitimacy and ethical role of cultural institutions as stewards for the public.

It is commendable when a collection proactively engages in discussions with foreign entities to right a past wrong. By following this course of action, it is possible for all stakeholders to determine the best outcome for displaced antiquities, without resorting to contentious and costly litigation (an expense that is burdensome for both private institutions and government entities). As such, creative results are possible, as in the Gilbert Trust’s agreement with Turkey. The Gilbert Trust made the decision to engage in proactive discussions with Turkey, a nation known to aggressively protect its cultural heritage and demand the repatriation of looted objects. However, by digging deeper into its collection to understand their histories, the ewer will finally return to its home, the Gilbert Collection will retain its unblemished reputation, and the V&A is engaging the public in discussions concerning ownership, history, and museum ethics.

It is commendable when a collection proactively engages in discussions with foreign entities to right a past wrong. By following this course of action, it is possible for all stakeholders to determine the best outcome for displaced antiquities, without resorting to contentious and costly litigation (an expense that is burdensome for both private institutions and government entities). As such, creative results are possible, as in the Gilbert Trust’s agreement with Turkey. The Gilbert Trust made the decision to engage in proactive discussions with Turkey, a nation known to aggressively protect its cultural heritage and demand the repatriation of looted objects. However, by digging deeper into its collection to understand their histories, the ewer will finally return to its home, the Gilbert Collection will retain its unblemished reputation, and the V&A is engaging the public in discussions concerning ownership, history, and museum ethics.

by Amineddoleh & Associates LLC | Oct 23, 2021 |

As a leading law firm in the NFT space with expertise in both art and intellectual property law, Amineddoleh & Associates LLC was selected to draft Monax’s template for the purchase and sale of NFTs.

Amineddoleh & Associates LLC is pleased to announce that it is working with Monax to further the company’s mission to deliver a comprehensive and cutting-edge digital contract platform that meets discerning users’ needs. Monax is a major player operating in the smart contracts market. It allows users to access and track agreement templates, as well as manage their contractual obligations throughout the life cycle of the contract. The model uses a combination of smart contract programming, blockchain technology, and business process modeling to offer users a unique, sophisticated tool to streamline and automate business contracts. It also reduces the likelihood of confusion and friction between contractual parties because the language is clear and accessible.

Amineddoleh & Associates LLC is pleased to announce that it is working with Monax to further the company’s mission to deliver a comprehensive and cutting-edge digital contract platform that meets discerning users’ needs. Monax is a major player operating in the smart contracts market. It allows users to access and track agreement templates, as well as manage their contractual obligations throughout the life cycle of the contract. The model uses a combination of smart contract programming, blockchain technology, and business process modeling to offer users a unique, sophisticated tool to streamline and automate business contracts. It also reduces the likelihood of confusion and friction between contractual parties because the language is clear and accessible.

As part of this initiative, our team was hired by Monax to create a template agreement for the sale of Non-Fungible Tokens (NFTs). NFTs are a new digital asset class ranging from artwork to GIFs, memes, Tweets, and even video clips of sporting events. Because they are tied to blockchain and cryptocurrency, NFTs straddle the divide between traditional and emerging property types, requiring a new way to deal with such transactions. As a result, Monax has implemented our one-of-a-kind template on its website as a resource for users who are buying and selling NFTs. NFTs identify and certify digital assets as unique items. While the digital image can still be duplicated, the NFT monetizes the images by allowing a buyer to purchase the unique token and, with it, ownership of the original digital object. There has been a growing market for art collectors who are buying and collecting NFTs like they would art, and in some cases, buying them for millions.

However, because NFTs are such innovative assets, collectors, purchasers, artists, and sellers all need contracts that protect their rights and accurately describe what is being included in the transaction. For instance, the purchase of an NFT does not automatically grant the buyer intellectual property rights in the original image (or video). An NFT agreement also offers artists the opportunity to obtain future royalties and exert greater control over their work. Depending on the parties’ specific needs, and the type of NFT in question, a more simple or complex contract may be required.

CryptoPunks NFTs (Larva Labs)

As a law firm specializing in art and intellectual property transactional and litigation matters, we were hired by Monax to draft its template, one of the first of its kind, because of our in-depth knowledge resulting from our continued work with artists, buyers, and sellers in the art world. As this new market continues to boom, we were pleased to draft the company’s novel template that is now available for future NFT buyers, sellers, and creators. Please note that our NFT template created for Monax is only a template, not a final agreement. Every sales transaction is unique and requires specific legal analysis necessitating nuanced transactional documents. We advise all artists, buyers, and sellers to consult with legal counsel prior to entering into an arts transaction.

In addition to the Monax template, our firm reviewed intellectual property terms and conditions for highly popular NFT marketplace Nifty Gateway, and we are currently developing other exciting NFT projects, such as a creative collaboration between a visual artist and well-known musician. As NFTs continue to evolve and grow within the digital marketplace and the art world, we look forward to participating in more projects and expanding our reach in this exciting new space.

If an effort to educate art market professionals about NFTs, Leila A. Amineddoleh will be discussing NFTs, luxury goods, and emerging technologies during the Art Law & Provenance module of the EXECUTIVE MASTER IN ART MARKET STUDIES at the University of Zurich.

by Amineddoleh & Associates LLC | Oct 17, 2021 |

The following article was contributed to Amineddoleh & Associates LLC by Emily A. Thompson, AAA. Ms. Thompson is an art advisor and qualified appraiser certified by the Appraiser’s Association of America (AAA) in post war, contemporary and emerging art. She serves on the membership committee of the Estate Planner’s Council of New York (EPCNYC) and maintains an adjunct faculty position with Sotheby’s Institute of Art.

As art fairs cautiously return and the auction season gears up, increased sales and acquisitions warrant a re-examining of due diligence in art transactions, both online and in real time. According to best practices suggested by non-profit initiative RAM (the Responsible Art Market initiative), “due diligence” is commonly defined as “action that is considered reasonable for people to be expected to take to keep themselves or others and their property safe”.[1] While there are companies proclaiming to eliminate art market risks via software programs, collectors should ask probing questions. Working with a seasoned advisor with art expertise can be invaluable because that person can spot inconsistencies in paperwork, investigate the validity and reputation of a source, and flag concerns for a collector’s attorney or tax advisor.

As art fairs cautiously return and the auction season gears up, increased sales and acquisitions warrant a re-examining of due diligence in art transactions, both online and in real time. According to best practices suggested by non-profit initiative RAM (the Responsible Art Market initiative), “due diligence” is commonly defined as “action that is considered reasonable for people to be expected to take to keep themselves or others and their property safe”.[1] While there are companies proclaiming to eliminate art market risks via software programs, collectors should ask probing questions. Working with a seasoned advisor with art expertise can be invaluable because that person can spot inconsistencies in paperwork, investigate the validity and reputation of a source, and flag concerns for a collector’s attorney or tax advisor.

An independent advisor may represent a collector in the sale of a work or group of works, or in acquiring art for a new or nascent collection. His or her role should be to aid clients not only by homing in on aesthetic goals, educating them about art and saving them money, but also by minimizing risk and keeping clients safe. Of primary importance, the advisor should abide by a code of ethics whereby they serve the needs of the client and are compensated by one party only. Art advisors may be compensated on a retainer basis, being paid an annual sum by the client based on the anticipated purchases during the year, or on a percentage basis per transaction, or a combination of both. If operating on a percentage basis, a sliding scale is often instituted, with a lower percentage charged by the advisor when the final sales price is above a certain threshold. Whatever the agreed upon arrangement, the payment structure and term of engagement should be outlined in a written contract or agreement letter prior to any acquisition or sale, with clarity on fee structure established at the outset, to ensure transparency and obligations.

The Object and Ownership interest

When evaluating object(s) in question, steps are required to verify the validity of what is being bought or sold and who has the legal authority to do so. On the buying side, it is not uncommon in the art world for an advisor to be offered the same picture by multiple parties – an image and some cataloguing information is no guarantee that the party offering the artwork has the authority to act on behalf of the legal owner. An experienced art advisor will work to confirm the ownership interest of the seller by determining how and when the artwork acquired by the seller. If a work is being sourced privately from an auction house or broker, is there a consignment agreement with the legal owner in place? Where is the work located? Is the artwork free of any liens against it which would affect the passing of clear and legal title? If the ownership structure is overly complex or opaque, or answers to ownership questions cannot be answered satisfactorily, an attorney may need to be consulted.

Due diligence should also be conducted on the object itself. Basic cataloguing describing the artist, medium, size and date of the piece(s) should be provided. The physical condition of an object should be clearly stated and checked, with a physical inspection conducted by the advisor or a contracted, third party, such as a conservator. Is the condition as represented and is it appropriate for the artist or object in question? Have there been extensive restorations or repairs? When reviewing item cataloguing, are there significant gaps in provenance, missing documentation, or lack of dated inventories? Databases such as the Art Loss Register and Interpol’s Stolen Works of Art can be searched to confirm that a work has not been previously lost or stolen. What are the appropriate authentication requirements set forth by market standards? For example, does the work require a certificate of authentication, a letter or ID number assigned from the artist or artists’ foundation or heirs for it to be sold? Is there a catalogue raisonne or established monograph to be consulted? Price databases such as Artnet can be searched for comparable sales as well as previous offerings of the subject work, which may have been omitted from a provided provenance (purposefully or not) and auction house catalogues, printed or now digitally online, can provide valuable information as to relevant literature and the correct expertise for confirming authenticity.

Depending on the collecting category, country of origin or materials may pose serious issues regarding the looting and illicit trafficking of cultural property. An artwork or object originating from known “source nations,” such as Greece or Italy, along with areas of increasing concern, such as Iraq and Syria, may be subject to trade restrictions. Items that were known to be in Europe between 1933 and 1948, in Eastern Europe and in the Soviet Union during the Communist era (between 1949 and 1990) or in Cuba during the revolutionary period (between 1953 and 1959), to name only a few, should be screened for potential title disputes. Also, some artworks incorporate restricted materials or material from endangered species, such as ivory or snakeskin, which may prohibit their legal trade.

Depending on the collecting category, country of origin or materials may pose serious issues regarding the looting and illicit trafficking of cultural property. An artwork or object originating from known “source nations,” such as Greece or Italy, along with areas of increasing concern, such as Iraq and Syria, may be subject to trade restrictions. Items that were known to be in Europe between 1933 and 1948, in Eastern Europe and in the Soviet Union during the Communist era (between 1949 and 1990) or in Cuba during the revolutionary period (between 1953 and 1959), to name only a few, should be screened for potential title disputes. Also, some artworks incorporate restricted materials or material from endangered species, such as ivory or snakeskin, which may prohibit their legal trade.

If the art professional offering the piece cannot satisfactorily establish the country of origin of the object and the circumstances under which it left, an attorney specializing in these areas may be needed to consult on the purchase.

Traditionally, the art market is one that has favored secrecy, but recent scrutiny by law enforcement agencies on the use of antiquities and high value art to launder money or evade sanctions has resulted in major implications for dealers, collectors, and anyone else engaged in the art trade. The 2020 enactment of the 5th European AML Directive in the EU and UK and the Anti Money Laundering Act of 2020 (AML Act) in the US have meant new compliance obligations across the industry aimed at increasing transparency in transactions and reducing risk for all parties involved. Collectors should expect to be asked to provide documentation verifying their identity, if buying or selling a work of art, such as a passport, driver’s license, or national ID card, as well as recent proof of residence, such as a current utility bill or bank statement.

Considerations at the transaction level include questioning whether a sale price is artificially low – or high. Are the payment terms suspect in any way (e.g., requests of cash-only transaction or sale proceeds paid to someone other than the seller)? While a contract – from the advisor or with a third-party vendor – will often include language pertaining to confidentiality and privacy, it should be an essential part of an advisor’s business practice to keep his or her own records and to ensure the client is aware of the information necessary to comply with increased regulations. It is also possible to have each side in a transaction reveal its identity to the other’s legal advisors, who can vet the other party and conduct the appropriate reviews.

Post Transaction Duties

Finally, an art advisor’s role should not end with the purchase or sale. On the contrary, additional responsibilities often include reviewing post-sale invoices for errors or omissions, supervising shipping, installation, and cataloguing to ensure that the work is adequately documented for their collection records. An advisor should ensure that the client’s insurance broker is alerted to a new acquisition so that the piece can be added to their scheduled policy and that, once professionally installed, risk factors in the space (high traffic areas, exposure from direct sunlight) are identified and minimized as much as possible.

Art advisors should not be in the business of giving tax advice, the particulars of which can be very complicated and case specific. However, advisors should be aware of possible tax implications for their clients at given points during and post transaction. In the US, sales tax differs by state, so a purchase made away from home could necessitate different filing protocols. Use Tax – when a purchase is made out-of-state and directly shipped to another – also varies by location and must be paid on the purchase in the receiving state.

When selling a work or works from a collection, estate or capital gains tax, the amount owed on the profit of an appreciated asset, may apply. If sold less than one year after its original purchase, income tax, which can be as high as 37%, may be applicable. Depending on the ultimate sale or purchase price, the tax implications for a client can be significant, so it is always good practice for an art advisor to direct their client to their CPA to ensure that there are no unanticipated surprises down the road.

The nature of the art market means ever changing sources, players, and directives. Professional advisors must work to keep pace with regulations and maintain a lawful, unbiased practice in all their dealings, performing the due diligence necessary to serve their clients in the most transparent and ethical manner possible.

by Amineddoleh & Associates LLC | Oct 13, 2021 |

Our founder, Leila A. Amineddoleh, is serving as Chair of the New York County Lawyers Association’s 13th Annual Art Law Institute: New Insights in Art Law. The association’s annual conference has long been a highlight of the art law calendar each year. It’s typically been a full-day conference, but (like last year) it will be held over two half-days, October 21 and 22, via Zoom.

Our founder, Leila A. Amineddoleh, is serving as Chair of the New York County Lawyers Association’s 13th Annual Art Law Institute: New Insights in Art Law. The association’s annual conference has long been a highlight of the art law calendar each year. It’s typically been a full-day conference, but (like last year) it will be held over two half-days, October 21 and 22, via Zoom.

Leila organized this year’s conference and she will be speaking about the application of Foreign Sovereign Immunities Act in art and antiquities disputes. Associate Claudia Quinones will also be presenting during the conference, discussing ownership disputes in the ever-popular “What’s New in Art Law” panel. Please join us for the conference by registering (for either one day or for both days) HERE.

One of the more sensational stories is that the mummy board was on the SS Titanic in 1912 and caused the ship to sink. However, this is only a rumor; the Unlucky Mummy has been on public display since the 1890s, except during WWI and WWII when it was placed in storage for safekeeping. It first left the British Museum in 1990 for a temporary exhibition at the National Gallery of Australia, and it made it back to London safe and sound. In fact, much of the mummy’s malevolent backstory was invented by English editor William T. Stead, who possessed a fascination with the supernatural. Ironically, Stead perished on the Titanic – but the Unlucky Mummy’s legacy lives on. It is allegedly responsible for multiple murders, illnesses, injuries, hauntings, eerie noises, flickering lights, and other suspicious activity.

One of the more sensational stories is that the mummy board was on the SS Titanic in 1912 and caused the ship to sink. However, this is only a rumor; the Unlucky Mummy has been on public display since the 1890s, except during WWI and WWII when it was placed in storage for safekeeping. It first left the British Museum in 1990 for a temporary exhibition at the National Gallery of Australia, and it made it back to London safe and sound. In fact, much of the mummy’s malevolent backstory was invented by English editor William T. Stead, who possessed a fascination with the supernatural. Ironically, Stead perished on the Titanic – but the Unlucky Mummy’s legacy lives on. It is allegedly responsible for multiple murders, illnesses, injuries, hauntings, eerie noises, flickering lights, and other suspicious activity.

Not only is the ewer a stunning example of ancient metalwork, it also possesses a fascinating history. This masterpiece was created by a Hattian goldsmith living in Anatolia over 4,000 years ago. The ewer was formed by embossing a single sheet of gold with complex patterns, including an ancient symbol of the sun, in order to accompany a Hattian ruler into the afterlife. When Gilbert acquired the ewer in 1989, he was dazzled by the evocative story as well as its beauty. However, because Gilbert was not very experienced in collecting these types of objects (this was the only archaeological object he ever bought), the seller was able to conceal the ewer’s illicit origins and misrepresent the origins of the piece.

Not only is the ewer a stunning example of ancient metalwork, it also possesses a fascinating history. This masterpiece was created by a Hattian goldsmith living in Anatolia over 4,000 years ago. The ewer was formed by embossing a single sheet of gold with complex patterns, including an ancient symbol of the sun, in order to accompany a Hattian ruler into the afterlife. When Gilbert acquired the ewer in 1989, he was dazzled by the evocative story as well as its beauty. However, because Gilbert was not very experienced in collecting these types of objects (this was the only archaeological object he ever bought), the seller was able to conceal the ewer’s illicit origins and misrepresent the origins of the piece. It is commendable when a collection proactively engages in discussions with foreign entities to right a past wrong. By following this course of action, it is possible for all stakeholders to determine the best outcome for displaced antiquities, without resorting to contentious and costly litigation (an expense that is burdensome for both private institutions and government entities). As such, creative results are possible, as in the Gilbert Trust’s agreement with Turkey. The Gilbert Trust made the decision to engage in proactive discussions with Turkey, a nation known to aggressively protect its cultural heritage and demand the repatriation of looted objects. However, by digging deeper into its collection to understand their histories, the ewer will finally return to its home, the Gilbert Collection will retain its unblemished reputation, and the V&A is engaging the public in discussions concerning ownership, history, and museum ethics.

It is commendable when a collection proactively engages in discussions with foreign entities to right a past wrong. By following this course of action, it is possible for all stakeholders to determine the best outcome for displaced antiquities, without resorting to contentious and costly litigation (an expense that is burdensome for both private institutions and government entities). As such, creative results are possible, as in the Gilbert Trust’s agreement with Turkey. The Gilbert Trust made the decision to engage in proactive discussions with Turkey, a nation known to aggressively protect its cultural heritage and demand the repatriation of looted objects. However, by digging deeper into its collection to understand their histories, the ewer will finally return to its home, the Gilbert Collection will retain its unblemished reputation, and the V&A is engaging the public in discussions concerning ownership, history, and museum ethics. Amineddoleh & Associates LLC is pleased to announce that it is working with Monax to further the company’s mission to deliver a comprehensive and cutting-edge digital contract platform that meets discerning users’ needs. Monax is a major player operating in the smart contracts market. It allows users to access and track agreement templates, as well as manage their contractual obligations throughout the life cycle of the contract. The model uses a combination of smart contract programming, blockchain technology, and business process modeling to offer users a unique, sophisticated tool to streamline and automate business contracts. It also reduces the likelihood of confusion and friction between contractual parties because the language is clear and accessible.

Amineddoleh & Associates LLC is pleased to announce that it is working with Monax to further the company’s mission to deliver a comprehensive and cutting-edge digital contract platform that meets discerning users’ needs. Monax is a major player operating in the smart contracts market. It allows users to access and track agreement templates, as well as manage their contractual obligations throughout the life cycle of the contract. The model uses a combination of smart contract programming, blockchain technology, and business process modeling to offer users a unique, sophisticated tool to streamline and automate business contracts. It also reduces the likelihood of confusion and friction between contractual parties because the language is clear and accessible.

As art fairs cautiously return and the auction season gears up, increased sales and acquisitions warrant a re-examining of due diligence in art transactions, both online and in real time. According to best practices suggested by non-profit initiative RAM (the Responsible Art Market initiative), “due diligence” is commonly defined as “action that is considered reasonable for people to be expected to take to keep themselves or others and their property safe”.

As art fairs cautiously return and the auction season gears up, increased sales and acquisitions warrant a re-examining of due diligence in art transactions, both online and in real time. According to best practices suggested by non-profit initiative RAM (the Responsible Art Market initiative), “due diligence” is commonly defined as “action that is considered reasonable for people to be expected to take to keep themselves or others and their property safe”. Depending on the collecting category, country of origin or materials may pose serious issues regarding the looting and illicit trafficking of cultural property. An artwork or object originating from known “source nations,” such as Greece or Italy, along with areas of increasing concern, such as Iraq and Syria, may be subject to trade restrictions. Items that were known to be in Europe between 1933 and 1948, in Eastern Europe and in the Soviet Union during the Communist era (between 1949 and 1990) or in Cuba during the revolutionary period (between 1953 and 1959), to name only a few, should be screened for potential title disputes. Also, some artworks incorporate restricted materials or material from endangered species, such as ivory or snakeskin, which may prohibit their legal trade.

Depending on the collecting category, country of origin or materials may pose serious issues regarding the looting and illicit trafficking of cultural property. An artwork or object originating from known “source nations,” such as Greece or Italy, along with areas of increasing concern, such as Iraq and Syria, may be subject to trade restrictions. Items that were known to be in Europe between 1933 and 1948, in Eastern Europe and in the Soviet Union during the Communist era (between 1949 and 1990) or in Cuba during the revolutionary period (between 1953 and 1959), to name only a few, should be screened for potential title disputes. Also, some artworks incorporate restricted materials or material from endangered species, such as ivory or snakeskin, which may prohibit their legal trade. Our founder, Leila A. Amineddoleh, is serving as Chair of the New York County Lawyers Association’s 13th Annual Art Law Institute: New Insights in Art Law. The association’s annual conference has long been a highlight of the art law calendar each year. It’s typically been a full-day conference, but (like last year) it will be held over two half-days, October 21 and 22, via Zoom.

Our founder, Leila A. Amineddoleh, is serving as Chair of the New York County Lawyers Association’s 13th Annual Art Law Institute: New Insights in Art Law. The association’s annual conference has long been a highlight of the art law calendar each year. It’s typically been a full-day conference, but (like last year) it will be held over two half-days, October 21 and 22, via Zoom.