Leila Discuss Copyright Law with The Art Newspaper

Leila A. Amineddoleh spoke with The Art Newspaper about the most recent copyright infringement litigation filed against Jeff Koons. Read the article HERE.

Leila A. Amineddoleh spoke with The Art Newspaper about the most recent copyright infringement litigation filed against Jeff Koons. Read the article HERE.

In this inaugural newsletter, Amineddoleh & Associates is pleased to share some major developments that took place at the firm during the summer and autumn of 2021.

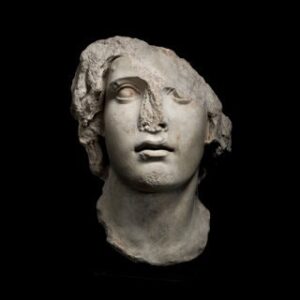

Ancient marble bust contested in lawsuit

Image from Manhattan DA’s Office

Amineddoleh and Associates secured a win for its client, the Italian Republic, in the ongoing Safani v. Republic of Italy litigation in the U.S. District Court for the Southern District of New York. The court dismissed litigation against our client in a case concerning an Italian antiquity seized from a Manhattan art gallery. Read about the litigation update here and the case details here.

(The Plaintiff has since filed a Second Amended Complaint, naming the Manhattan District Attorney as a defendant in the case.)

In this blog post, our founder Leila Amineddoleh discusses disgraced art dealer Nancy Wiener, who revealed new details about her involvement in the illicit trafficking of antiquities and its effect on the art market in an allocution statement. Wiener had ties to Douglas Latchford, whose recent appearance in the Pandora Papers leak highlights the global nature of the illicit antiquities trade. Read more on our website.

There were a number of developments this autumn concerning Nazi-Era looting. We presented an entry in our popular Provenance Series to examine the issues surrounding the restitution of looted cultural heritage in Poland, including the country’s history, a new law shortening the applicable statute of limitations, and examples of successful returns. Read more on our website. In addition, questions continue to arise concerning alleged duress sales, with one painting in Houston’s Museum of Fine Arts coming under scrutiny. Founder Leila Amineddoleh discussed the case and its implications with media outlets.

Gold ewer

Image from V&A

Firm founder Leila Amineddoleh consulted with the Gilbert Trust at the Victoria & Albert Museum concerning a 4,250 year old golden ewer that was returned to Turkey in October. The ewer was purchased by a private collector who was unaware of the seller’s dirty dealings, including his involvement in antiquities trafficking. Luckily, the Gilbert Trust was proactive and the matter was resolved amicably and creatively. Read about the ewer’s fascinating history and the details of its return here.

With the ongoing NFT craze, market participants and legal scholars have been waiting for guidance from courts concerning the application of “traditional” intellectual property law to this new digital asset class. We authored a blog post discussing the legal questions and controversies arising as the NFT market continues to grow. NFTs recently made headlines when Miramax sued Quentin Tarantino. Tarantino, the award-winning movie director, announced his plan to sell a new NFT collection consisting of seven tokens to uncut, exclusive scenes from Pulp Fiction. In response, Miramax sued Tarantino for breach of contract, as well as copyright and trademark infringement. Read more about NFTs and this new lawsuit here.

Several artifacts seized from Steinhardt

Image from DA’s Office

This blog post details the Manhattan District Attorney’s Office seizure of 180 looted antiquities from Michael Steinhardt. Steinhardt, a hedge-fund pioneer and one of the world’s most prolific collectors of ancient art, was involved in a criminal investigation examining issues with the provenance of various pieces in his collection. The DA’s Office announced that Steinhardt has been sanctioned by placing him under a lifetime ban on the purchase of antiquities. All of the seized antiquities will be returned to their country of origin. Read more about this news on our website. Our founder served as an independent cultural heritage law expert for the seizure of certain items in Steinhardt’s collection. She discussed this with a number of news outlets, including WNYC.

Our firm added two new members to its roster this fall: Travis Mock and Deanna Schreiber. Travis is an attorney with a wealth of experience in litigation, IP law and trademarks, while Deanna is 3L at Fordham Law School interested in both transactional and litigation aspects of art and cultural heritage law. Deanna was the winner of the NY State Bar Association’s writing competition for her submission discussing the Foreign Sovereign Immunities Act and its future role in Nazi-looted art controversies. We wish Travis and Deanna a warm welcome. Learn more about our team and their accomplishments here.

Congratulations to our firm’s founder Leila Amineddoleh, who successfully chaired the 13th Annual NYCLA Art Law Institute, one of the most anticipated events of the year. Leila also spoke on the topic of foreign sovereign immunity while Associate Claudia Quinones participated in the ever-popular What’s New in Art Law? panel, focusing on title disputes. Check out the conference program and speaker details here.

In early December, Leila and Claudia also spoke at an international conference, The Intentional Destruction of the Cultural Heritage of Mankind, organized by Università degli Studi di Roma “La Sapienza.” They discussed cultural heritage as a human right as well as measures of legal protection in times of peace and conflict. In November, Leila presented a 3-hour lecture on the topic of NFTs for the Executive Master in Art Market Studies at the University of Zurich. Earlier in the month, she presented on “New Obligations in the Art & Antiquities Markets” for the Responsible Art Market Initiative. She also presented a featured lecture, “Cultural Heritage, the Law and Looting,” for the Department of Art History at New York University in October. Before that, she spoke about Nazi Looted Art and the Guelph Treasure for the International Center of Medieval Art.

Our firm was hired to create a unique template for the sale and purchase of NFTs on Monax. The company’s cutting-edge digital platform will combine technological expertise with art market considerations to provide users with full support for these emerging digital assets. As NFTs continue to increase in price and popularity, this template has the potential to revolutionize the market. Read more about NFTs and Monax’s services here. A&A also advised Nifty Gateway on its Terms & Conditions, and we have been working with a number of clients on new NFT projects.

Fragrance of Infinity: Hiroshi Sugimoto’s limited edition perfume bottle

Copyright: Diptyque

In honor of Diptyque’s 60th anniversary, our client Hiroshi Sugimoto collaborated with the fragrance house on a limited edition perfume bottle inspired by the Japanese region of Kankitsuzan. The artist used his childhood memory of seeing the ocean for the first time to create a striking form exploring the relationship between man and nature. More information on the collection can be found here.

In honor of Veterans Day, the People’s Picture (our client) was commissioned by America250 to create a digital photo mosaic depicting African American WWI hero Sgt. Henry Johnson for its November Salute 2021. The stunning mosaic, containing hundreds of photographs of veterans and other military personnel, is accessible online here and you can read more about The People’s Picture and their work here.

A number of our artist-clients received recognition for international art exhibitions over the past year, including the talented Kamrooz Aram. In addition, our collector-clients and dealer-clients were also actively buying and selling art through both online platforms and in-person art fairs.

As television viewership numbers increase during the pandemic, it is a pleasure to work with producers, writers, and on-screen talent creating exciting programs. One of these clients is Terra Incognita, a company producing content for educational, travel, and documentary programming. They focus on high-quality and thought-provoking ideas to empower audiences around the world.

On behalf of Amineddoleh & Associates, we wish you a happy holiday season and wonderful new year.

Amineddoleh & Associates LLC is pleased to welcome Travis J. Mock to our team as Of Counsel. Travis has an impressive resume, with over a decade of experience in both litigation and transactional matters. Before joining our practice, Travis worked for over eight years in two global law firms, where he focused on commercial contract and civil fraud litigation. He also worked for three years in litigation boutiques, including most recently Pincus Law, where he represented investors, entrepreneurs, and small businesses, as well as several leading social media companies.

Amineddoleh & Associates LLC is pleased to welcome Travis J. Mock to our team as Of Counsel. Travis has an impressive resume, with over a decade of experience in both litigation and transactional matters. Before joining our practice, Travis worked for over eight years in two global law firms, where he focused on commercial contract and civil fraud litigation. He also worked for three years in litigation boutiques, including most recently Pincus Law, where he represented investors, entrepreneurs, and small businesses, as well as several leading social media companies.

Throughout his career, Travis has been committed to pro bono and non-profit work. He led the multi-year defense of a critically ill woman artist being evicted from her rent-controlled housing. He also served for several years as pro bono outside general counsel for the YWCA Brooklyn. Travis is a long-time supporter of Volunteer Lawyers for the Arts.

In addition to his legal expertise, Travis is also a musician. A lifelong singer and former trumpeter, these days he enjoys learning classical, jazz, and bluegrass guitar. His three-year-old daughter thinks he is very talented.

Our founder at the repatriation ceremony for the Bull’s Head in 2017

Today, the Manhattan District Attorney (DA) Cyrus Vance announced that Michael Steinhardt, hedge-fund pioneer and one of the world’s most prolific collectors of ancient art, surrendered 180 looted antiquities valued at $70 million. This unprecedented seizure is the result of a criminal investigation that began several years ago. Amineddoleh & Associates previously wrote about a looted Bull’s Head had been purchased by Steinhardt in 2010 for $700,000, who subsequently loaned it to the Metropolitan Museum of Art. After museum personnel raised concerns as to the provenance of the object, it came to light that the sculpture had been looted during the Lebanese Civil War. The Bull’s Head, as well as an ancient marble torso depicting a calf bearer, were both tied to the black market, seized by the DA’s Office, and subsequently repatriated. Both items had been extensively photographed during their excavation in 1967, and storage records placed them at a Lebanese warehouse before they were stolen in 1981. Notably, there was “not a single piece of paper” accounting for the provenance of the Bull’s Head between its disappearance and later sale at a London dealership in the 1990s.

Despite the presence of multiple red flags during the acquisition process, Steinhardt failed to prioritize due diligence when purchasing these objects. Most of the antiquities in his collection were trafficked during periods following civil unrest or armed conflict and depicted covered in dirt or other encrustations in photographs prior to their purchase. The seized objects span 11 countries and 12 criminal smuggling networks, and all had deficient provenance histories – or more troublingly, no information at all as to their origins – at the time of sale. It is incredulous that Steinhardt was unaware of his illegal acts. “For decades, Michael Steinhardt displayed a rapacious appetite for plundered artifacts without concern for the legality of his actions, the legitimacy of the pieces he bought and sold, or the grievous cultural damage he wrought across the globe,” said District Attorney Vance. “His pursuit of ‘new’ additions to showcase and sell knew no geographic or moral boundaries, as reflected in the sprawling underworld of antiquities traffickers, crime bosses, money launderers, and tomb raiders he relied upon to expand his collection.”

In a major announcement, the DA’s Office reached an agreement to put an end to the legal process filed against Steinhardt, whereby all the antiquities formerly in his possession will be returned to their countries of origin rather than being held as evidence in a lengthy criminal procedure. Vance also indicated that his office is currently carrying out joint parallel investigations with foreign law enforcement, and this measure will protect the integrity of the process and potential witnesses. Most importantly, Steinhardt was given a lifetime ban on the purchase of antiquities, the first time such an extreme sanction has been imposed. This indicates the seriousness with which the DA’s Office views the illicit trafficking of antiquities and other cultural heritage objects and heralds more stringent oversight for private players in the New York art market.

The Steinhardt seizure represents a significant achievement for the Manhattan DA’s Antiquities Trafficking Unit (led by Matthew Bogdanos), which has recovered thousands of stolen cultural heritage objects collectively valued at over $200 million since its inception in 2017, and repatriated a total of 717 pieces to 14 nations over the past year.

Amineddoleh & Associates LLC has been watching this matter closely. Our founder, Leila A. Amineddoleh served as the cultural heritage law expert for a number of the warrants used to seize dozens of items from Steinhardt’s collection, including the Lebanese Bull’s Head. (We note that Leila has never been, and is not currently, employed by the Manhattan DA’s Office, but has instead served as an independent expert.)

Last month our founder was honored to present a 3-hour lecture on the topic of NFTs and collectibles for the EXECUTIVE MASTER IN ART MARKET STUDIES the University of Zurich. During her lecture, she spoke about a high-profile litigation involving NFTs (a discussion of the case follows). Amineddoleh & Associates LLC had been at the forefront of the NFT market, working with platforms (including Nifty Gateway), automated contract providers (Monax), and minters, artists, and collectors.

As the popularity of NFTs continues to grow, legal questions and controversies have arisen in this emerging field. Several of these disputes concern artists’ rights over the minted material that is being sold, sometimes without their knowledge or consent. However, in other cases, copyright holders (who are not the creators of the source material) are alleging infringement and filing suit to prevent the sale and distribution of NFTs.

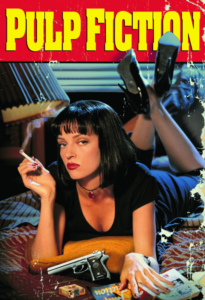

Copyright: Miramax

A recent case involves celebrated director Quentin Tarantino. Early last month, he announced he seven secret NFTs of uncut, exclusive scenes from his cult film, Pulp Fiction. The film, released in 1994, was written and directed by Tarantino, produced by Lawrence Bender and starred Hollywood heavyweights John Travolta, Samuel L. Jackson, and Uma Thurman. It was Miramax’s first release after being acquired by Disney and it was completely financed by Miramax. Since its release, Pulp Fiction has earned critical acclaim. It has grossed over $213 million worldwide and Tarantino won an Academy Award for Best Original Screenplay. The highly-anticipated Pulp Fiction NFT collection will consist of seven tokens, each of which will be a single, iconic scene “from the never-before-seen, handwritten screenplay” and will contain “personalized audio commentary” from Tarantino. The NFT announcement prompted Miramax to SUE Tarantino in California for breach of contract, as well as copyright and trademark infringement.

Pulp Fiction Secret NFTs

As part of the sale process for Mr. Tarantino’s NFTs, a WEBSITE HAS BEEN CREATED which provides information about secret NFTs generally and the Pulp Fiction series. The website also offers access to an interest form and waiting list, along with instructions on how to buy the NFTs. It explains that the NFTs are part of a new asset class, called secret NFTs. Secret NFTs have enhanced privacy and access controls and live on the Secret Network. This means that the “owner will enjoy the freedom of choosing between: 1. Keeping the secrets to themselves for all eternity. 2. Sharing the secrets with a few trusted loved ones. 3. Sharing the secrets publicly with the world.”

Miramax’s Legal Arguments

Miramax bringing out the “big guns”

Copyright: Miramax

Shortly after Tarantino’s announcement, Miramax served him with a CEASE-AND-DESIST LETTER on November 4. According to Miramax, Mr. Tarantino’s plan to sell “intensified and expanded” when @TarantinoNFTs tweeted that the Pulp Fiction NFTs will include scans of pages from Pulp Fiction script and the Artifacts Collection of iconic props from Mr. Tarantino’s major films including “one from Pulp Fiction.”

On November 16, Miramax filed a lawsuit against Tarantino in the U.S. District Court for the Central District of California. The complaint alleges breach of contract, copyright infringement, trademark infringement, and unfair competition. Miramax claims that Tarantino’s limited contractual rights over Pulp Fiction, which include interactive games, live performances, and other ancillary media, exclude NFTs linked to the screenplay. Tarantino has the right to publish portions of the screenplay, but the proposed sale of original pages or scenes in NFT format could be considered a one-time transaction rather than a publication. Moreover, the company argues that Tarantino’s use of Pulp Fiction branding and imagery will confuse buyers into thinking that the NFTs are official Miramax products. However, this has not deterred Tarantino from proceeding with the upcoming sale.

Miramax is seeking a jury trial, unspecified monetary damages, and injunctive relief, aiming to stop planned December sale, as well as frustrate any of Tarantino’s future efforts infringing on what Miramax believes to be its rights to Pulp Fiction. The company is concerned that if Tarantino prevails, this will set a PRECEDENT for other creators to “exploit Miramax films through NFTs and other emerging technologies, when in fact Miramax holds the rights for these films.” The effects of a ruling in favor of Tarantino could spill over to other film companies, placing them in direct competition with creators. For example, when a company releases and sells NFTs related to a film (as in the case of Space Jam: A New Legacy during July 2021), those profits may need to be shared.

The complaint outlined that Tarantino was subject to several agreements limiting his rights to reproduce certain content related to Pulp Fiction. This included a Rights Agreement between Tarantino, Bender, and Miramax, a transfer of rights agreement between Tarantino and B25 Productions with Miramax’s consent, an assignment agreement for the benefit of Miramax, as well as several other agreements.

Under these agreements, Miramax states that they were granted:

“all rights (including all copyrights and trademarks) in and to the Film (and all elements thereof in all stages of development and production) now or hereafter known including without limitation the right to distribute the Film in all media now or hereafter known (theatrical, non-theatrical, all forms of television, home video, etc.).”

However, the contracts also reserve rights to Tarantino, including: “soundtrack album, music publishing, live performance, print publication (including without limitation screenplay publication, ‘making of’ books, comic books and novelization, in audio and electronic formats as well, as applicable), interactive media, theatrical and television sequel and remake rights, and television series and spinoff rights.”

Given the rights granted to each party, Miramax believes that Tarantino is in breach of contract, as well as infringing on Miramax’s copyrights. The question turns on whether these NFTs are covered by the rights reserved by Tarantino.

In the complaint, Miramax distinguishes the language used to grant each party their rights. It characterizes Tarantino’s reserved right as a “narrowly-drafted, static exception to Miramax’s broad, catch-all rights” and “do[es] not contain any forward-looking language.” By contrast, the language used to describe Miramax’s rights is labeled as broad and forward looking. It grants Miramax “all rights . . . now or hereafter known . . . in all media now or hereafter known”.

Regardless of the specific forward-looking language in the contracts, the rights do not specifically address NFTs. Over three decades ago, the parties to the agreements did not contemplate the existence of NFTs. Thus, this gives either party arguments as to why the rights in the contracts may or may not allow the sale of these NFTs.

Tarantino’s Legal Argument

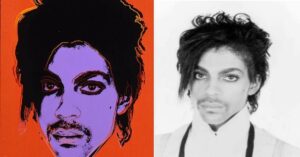

Image from Warhol Foundation v. Goldsmith litigation

Tarantino’s counsel stated in an email to Miramax that he and his client believe that the NFTs are covered under Tarantino’s reserved “print publication” or “screenplay publication” right. Under copyright law, a small distribution of a protected good, to a limited pool is not considered a “publication” and the complaint argues Tarantino’s proposed sale is of a “few original script pages or scenes” and an NFT is only a “one-time transaction.” However, given the novelty of NFTs, it is unclear whether a court would consider them a “publication.” But, since NFTs can be openly shared and produced, this may undermine Miramax’s argument.

Another legal defense that may be available to Tarantino is the Fair Use Doctrine. This allows courts to “avoid the rigid application of the Copyright Act when such application would stifle the very creativity the law was designed to foster” and can be used as an affirmative defense in copyright and trademark infringement cases. Under this doctrine, criticism, commentary, news reporting, teaching, scholarship, or research are listed as purposes for which the use of copyrighted work may be considered fair.A court may also find that the use is fair if the work is deemed transformative.

To determine fair use, courts balance four considerations: (1) the purpose and character of the use; (2) the nature of the copyrighted work; (3) the amount and substantiality of the portion used; and (4) the effect of the use upon the potential market for the copyrighted work. Cariou v. Prince, 714 F.3d 694, 705 (2d Cir. 2013). Transformative use must “communicat[e] something new and different from the original or expan[d] its utility.” Authors Guild v. Google, Inc., 804 F.3d 202, 214 (2d Cir. 2015). Simply transposing a work from one medium to another does not necessarily qualify as transformative fair use. See Andy Warhol Foundation for the Visual Arts, Inc. v. Goldsmith, 992 F.3d 99 (2021).

It is clear that NFTs are creating a new art market and reconfiguring conceptions of copyright for intangible assets. In the sale of NFTs, the Fair Use Doctrine may protect against constant copyright lawsuits. While some NFTs are parodies or commentaries on popular culture or other well-known images or videos, the Pulp Fiction NFTs are directly related to the product for which Miramax holds the copyrights. However, unlike other NFTs, Tarantino is building on and adding to the copyrighted work. By adding commentary and exclusive material, he is arguably “transforming” the stills encapsulated in the NFT series.

A work used for commercial activity, as compared to non-commercial activity, generally weighs against a finding of fair use. Tarantino’s NFT website states that he is selling the Pulp Fiction NFTs because he “is enamored with Pulp Fiction, a timeless creation, and as such wanted to give the public a new glimpse into the iconic scenes from the screenplay of the film.” Further, the website notes that Tarantino sees himself “as an artist” and these NFTs explore “new, exciting mediums to express his artistic style and ideas.” This suggests that he believes that these NFTs are his artistic expression that builds on this cult classic.

However, it could also be argued that Tarantino’s use of the copyrighted material falls within the scope of commercial use, if one considers the broader NFT market. There is a very large value that could be derived from the sale of these NFTs. The fact that people have been selling NFTs for a monetary benefit may suggest that Tarantino’s sale is commercial and it will weigh against his fair use defense. In terms of financial gain, one of Miramax’s attorneys stated that: “This one-off effort devalues the NFT rights to Pulp Fiction, which Miramax intends to maximize through a strategic, comprehensive approach.” In the company’s opinion, the NFTs are considered economic, rather than artistic, assets and Tarantino has deprived Miramax of this revenue stream.

Nonetheless, it could also be argued that the NFTs are not “simply transposing a work from one medium to another,” which supports Tarantino’s fair use defense. The NFTs will include scenes from the Miramax’s copyrighted material, but they will also include “personalized audio commentary from Quentin Tarantino”. Commentary on major scenes in a critically acclaimed movie from the man that wrote and directed the film is certainly a way of adding to the existing material in a way that could be considered transformative when compared to the original.

As the purpose of the Fair Use Doctrine states, intellectual property laws exist to allow freedom of expression. While Tarantino may have entered into a contractual agreement with Miramax, and Miramax may hold copyrights “to the Film (and all elements thereof in all stages of development and production)” as well as to the “right to distribute the Film in all media now or hereafter known (theatrical, non-theatrical, all forms of television, home video, etc.),” Tarantino is arguably creating new content and is entitled to benefit from his artistic output.

Conclusion

As the NFT market continues to boom, many lawyers are considering novel legal arguments related to digital assets, especially in connection with copyright laws. Miramax v. Pulp Fiction is a lawsuit that is receiving and will continue to attract attention. Both sides have arguments and legal theories in their respective favor. It will certainly be interesting to follow the court’s analysis as it considers this landmark controversy, which will likely serve as a model for future claims, both in and beyond the entertainment industry. It is also possible that new regulations or guidelines will be created to address the specific legal issued posed by NFTs, given the volatility of the crypto market and increased scrutiny by legislators.

It is important for both creators and copyright holders interested in making, buying, and selling NFTs to be aware of their remedies and consult legal professionals where appropriate. Read more on NFTs and the work carried out by Amineddoleh & Associates in this field, INCLUDING a cutting-edge template agreement for Monax, on our BLOG.